| ☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

| ☒ | No fee required. |

Fee paid previously with preliminary materials. | ||||||

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and | ||||||

0-11. | ||||||

2024 NOTICE AND PROXY STATEMENT AVERY DENNISON

NOTICE OF ANNUAL

Notice of 2018 Annual Meeting of Stockholders

To Our Stockholders:MEETING OF STOCKHOLDERS

We cordially invite you to attend our 2018 Annual Meeting of Stockholders at the Embassy Suites, 800 North Central Avenue, Glendale, California 91203 on Thursday, April 26, 2018, at 1:30 p.m. Pacific Time. At the meeting, we will conduct the following items of business:

RECORD DATE | February 26, 2024 | |||

MEETING DATE | April 25, 2024 | |||

MEETING TIME | 2:30 p.m. Eastern Time | |||

MEETING FORMAT | Virtual at www.virtualshareholdermeeting.com/AVY2024 | |||

ITEMS OF BUSINESS FOR STOCKHOLDER VOTE | |||

| 1 | Election of the | ||

| 2 | Approval, on an advisory basis, of our executive | ||

| 3 | Approval of a Certificate of Amendment to our Amended and Restated Certificate of Incorporation to provide that stockholders holding 25% of our outstanding common stock have the right to request that we call special meetings of stockholders | ||

| 4 | Ratification of the appointment of | ||

Our Board recommends that you voteFOR each of theour 10 director nominees in Item 1 andFOR Items 2, 3 and 3. After Dean Scarborough, our Chairman, conducts these items of business at the meeting, Mitch Butier, our President and Chief Executive Officer, will discuss our 2017 performance and answer your questions.4.

Stockholders of record as of February 26, 20182024 are entitled to notice of, and to vote at,in connection with, the meeting and any adjournment or postponement thereof. This notice and our definitive proxy statement are being first mailed or made available to stockholders on or about March 11, 2024.

We want your shares to be represented and voted. We encourage you to vote promptly as this will save us the time and expense of additional proxy solicitation. As shown below, you can vote online, by telephone, by mail or, in certain circumstances, during the meeting.

On behalf of our Board of Directors, management and team members worldwide, thank you for investing in us and our company. We look forward to engaging with you during the virtual Annual Meeting.

Vikas Arora

Vice President, Associate General Counsel and

Corporate Secretary

March 11, 2024

| ONLINE | | BY TELEPHONE | | BY MAIL | | DURING MEETING | |||||||||

| You can vote online using the 16-digit control number shown on your Notice of Internet Availability, proxy card or voting instruction form. | In the U.S. and Canada, you can vote by telephone using the 16-digit control number shown on your Notice of Internet Availability, proxy card or voting instruction form. | You can vote by mail by completing, dating and signing your proxy card or voting instruction form and returning it in the accompanying postage-paid envelope. | Registered holders can vote during the meeting. Beneficial holders must contact their broker or other nominee to be able to vote during the meeting. Shares held through our Employee Savings Plan may not be voted during the meeting. | ||||||||||||

TABLE OF CONTENTS

Avery Dennison Corporation | 2024 Proxy Statement | Table of Contents |

PROXY SUMMARY

This proxy summary includes key messages related to this proxy statement and does not contain all the information you should consider before voting. We strongly encourage you to read the entire proxy statement before voting.

INFORMATION REGARDING ANNUAL MEETING

Distribution of Proxy Materials

We will bebegin mailing our Notice of Internet Availability of Proxy Materials, which includes instructions on how to access these materials on the Internet,online and vote your shares, on or beforeabout March 15, 2018.11, 2024. If you previously elected to receive a paper copy of our proxy materials, on or about the same date, we will mail you a proxy card and our 2018 proxy statement; 2017 annual2023 integrated financial and sustainability report (our “2023 Integrated Report”), which includes a letter to stockholders from our ChairmanPresident/Chief Executive Officer (CEO); a description of our businesses, stakeholders and President/CEO;values; highlights of our strategies, financial performance and a proxy cardsustainability progress; our Annual Report on or about March 16, 2018.

We want your shares to be representedForm 10-K for the fiscal year ended December 30, 2023 (our “2023 Annual Report”); and voted. You can vote as shown in the chart below.

| ||

| ||

| ||

| ||

On behalf of the Board of Directors, management and employees of Avery Dennison, thank you for your continued support.

|

TABLE OF CONTENTS

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

Avery Dennison Corporation| 2018 Proxy Statement |Table of Contents

This section summarizes information described in greater detail in other parts of this proxy statement for our 2024 Annual Meeting of Stockholders (the “Annual Meeting”).

Time, Date and does not contain all the information you should consider before voting. We encourage you to read the entire proxy statement before voting.Format of Annual Meeting

TIME AND LOCATION OF ANNUAL MEETING

The Annual Meeting will take place at 1:2:30 p.m. PacificEastern Time on April 26, 2018 25, 2024. To allow stockholders to attend without the time and expense of doing so in person, the meeting will be held virtually, with attendance via the internet. To attend the virtual Annual Meeting, you will need to log in to www.virtualshareholdermeeting.com/AVY2024 using the 16-digit control number on your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form.

Online access to the live audio webcast of the Annual Meeting will open at 2:15 p.m. Eastern Time to allow time for you to log in and test your device’s audio system. We encourage you to access the Embassy Suites, 800 North Central Avenue, Glendale, California 91203.meeting in advance of its start time as we plan to begin the meeting promptly. For additional instructions on how to attend the virtual Annual Meeting, please refer to the Voting and Meeting Q&A section of this proxy statement.

ITEMS BEING VOTED ON AT ANNUAL MEETING

Items Being Voted on During Annual Meeting

You are being asked to vote on the items of business shown below atduring the Annual Meeting. Our Board of Directors (our "Board"“Board”) recommends that you vote FOR all 11for each of our 10 director nominees and FORfor Items 2, 3 and 4.

ITEM OF BUSINESS | BOARD RECOMMENDATION | VOTE REQUIRED | DISCRETIONARY BROKER VOTING | PAGE | ||||||||

| 1 | Election of directors |  | FOR | Majority of votes cast |

No |

39 | ||||||

2 | Advisory vote to approve executive compensation |  | FOR

|

Majority of shares represented and entitled to vote |

No |

50 | ||||||

| 3 | Approval of a Certificate of Amendment to our Amended and Restated Certificate of Incorporation to provide that stockholders holding 25% of outstanding common stock have the right to request that we call special meetings of stockholders |  | FOR | Majority of shares outstanding | No | 94 | ||||||

| 4 | Ratification of appointment of PwC as our independent registered public accounting firm for FY 2024 |  | FOR | Majority of shares represented and entitled to vote | Yes | 96 | ||||||

Voting Prior to or During Annual Meeting

You may vote your shares by submitting a proxy in advance of the twoAnnual Meeting online, by telephone or by mail; only in certain circumstances may you vote during the meeting. If you are a registered stockholder who has not previously voted or wants to change your vote, you may vote during the Annual Meeting. Beneficial holders may only vote during the meeting if they properly request and receive a legal proxy in their name from the broker, bank or other nominee that holds their shares. Shares held through our Employee Savings Plan may not be voted during the meeting. Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote and submit your proxy promptly by following the instructions on your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form.

Avery Dennison Corporation | 2024 Proxy Statement | 1 |

Asking Questions During Annual Meeting

We have designed the virtual Annual Meeting to ensure that you have the same rights and opportunities to participate as you would at an in-person meeting, with an easy-to-use online platform that allows you to attend, vote and ask questions. After we have finished acting upon the Annual Meeting items beingof business and the meeting is adjourned, our Executive Chairman will lead a Q&A session during which we intend to answer all questions submitted timely that are pertinent to our company or the items brought before the stockholder vote. Answers to questions not addressed during the meeting, if any, will be posted promptly after the meeting on the investors section of our website. For information on how to submit questions during the Annual Meeting, please refer to the Voting and Meeting Q&A section of this proxy statement.

We are a global materials science and digital identification solutions company that provides a wide range of branding and information solutions that optimize labor and supply chain efficiency, reduce waste, advance sustainability, circularity and transparency, and better connect brands and consumers. Our products and solutions include labeling and functional materials, radio frequency identification (RFID) inlays and tags, software applications that connect the physical and digital, and a variety of products and solutions that enhance branded packaging and carry or display information that improves the customer experience. We serve an array of industries worldwide, including home and personal care, apparel, general retail, e-commerce, logistics, food and grocery, pharmaceuticals and automotive.

Our company is composed of two reportable segments, Materials Group and Solutions Group. Materials Group is a leading provider to pressure-sensitive label and graphics industries worldwide. Our innovative products include label materials, graphics and reflective materials and functional bonding materials, such as tapes. Our label materials enhance shelf appeal for brands, inform shoppers, advance circularity, increase transparency, help reduce waste and improve operational supply chain efficiency. Our graphics portfolio offers highly engineered materials that range from vehicle wraps to architectural films. Materials Group plays a key role in advancing our fast-growing Intelligent Labels business, providing the materials science capabilities and process engineering expertise essential to developing and manufacturing intelligent labels at scale.

Solutions Group is a leading global provider of information and branding products and solutions that cover a breadth of customer needs from digital identification and data management, branding and embellishment, as well as productivity, pricing and retail media. We empower customers across multiple retail and industry segments to connect the physical and digital, leveraging our industry-leading RFID solutions. Our technology addresses complex customer challenges, provides transparency and visibility across supply chains, improves labor and waste efficiency, and enables better consumer experiences at the point of purchase and beyond. Market segments served include the global apparel, logistics, food and grocery, and general retail industries. As a large ultra-high frequency RFID solutions provider, we leverage our innovation and data management capabilities, global footprint and market access in the ongoing advancement of our Intelligent Labels business.

STRATEGY OVERVIEW

We striveare committed to create superiorensuring the long-term sustainable value forsuccess of all our stakeholders – our customers, investors, employees and investors and improvecommunities. Over the communities in whichpast five years, we operate. To realize the business aspects of this vision, we arehave focused on executing the following key strategies:delivering to our potential by managing through macro volatility while evolving our aspirations. In 2023, we evolved our long-term strategies as shown below, adding a vital new one that reflects our growing Materials and Solutions connected capabilities and combining two of our former strategies into one.

•DrivingDrive outsized growth in

high valuehigh-value product categorieswith higher growth and margin potential (e.g., specialty labels, graphics, industrial tapes and radio-frequency identification (RFID));•Growingthrough market-driven innovationGrow profitably in our base

business through tailored go-to-market strategiesbusinessesLead at the intersection of the physical and

disciplined execution;•Maintaining our relentlessdigitalEffectively allocate capital and relentlessly focus on productivity

Lead in an environmentally and socially responsible manner

Our customers are increasingly looking for help solving some of the most complex industry challenges, including labor efficiency and supply chain effectiveness; waste reduction, circularity and transparency; and better connection between brands and consumers. We believe that physical items will need a digital identity to solve these challenges, and that we are well-positioned to help the industries we serve overcome them. Our vision is to leverage the strengths of our Materials and Solutions businesses to lead at the intersection of the physical and digital.

2

2024 Proxy Statement | Avery Dennison Corporation

We plan to realize this vision through continued operational excellencesegment leadership, market-driven innovation, and enterprise lean sigma;advancement of integrated digital solutions, leveraging our Intelligent Labels business. Our areas of focus address key megatrends that present both risks and

Our strategies prioritize using our market insights, driving long-term innovation and enhancing the digital capability of our teams, while continuing to execute well in the core businesses that have been key to our success. Our five strategic pillars and 2023 achievements are shown below.

STRATEGIC PILLARS

1 | ||||

Drive outsized growth in high-value categories through market-driven innovation

We aim to increase, both organically and through acquisitions, the proportion of our portfolio in high-value categories that serve markets that are growing faster than gross domestic product (GDP), represent large pools of potential profit and leverage our core capabilities. These products and solutions include our Intelligent Labels that use RFID tags and inlays, specialty and durable label materials, graphics and reflective solutions, industrial tapes, external embellishments, and shelf-edge pricing, productivity and consumer engagement solutions.

| • | In 2023, we continued to increase the proportion of our portfolio in high-value product categories, with significant organic growth in Intelligent Labels, external embellishments, and shelf-edge pricing, productivity and consumer engagement solutions, and the acquisition of three companies that expand the external embellishment capabilities in our Solutions Group. Over the past five years, we more than doubled the size of our Intelligent Labels business, with net sales of ~$850 million in 2023. |

2 | ||||

Grow profitably in our base businesses

| • | We strive to grow profitably in our base businesses by carefully balancing volume, price and mix, reducing complexity and tailoring our go-to-market strategies. |

| • | In 2023, we protected margins in our base businesses through product reengineering and productivity actions to mitigate the impact of lower volume as the industries we serve experienced significant inventory destocking. |

3 | ||||

Lead at the intersection of the physical and digital

We connect the physical and digital, leveraging the core capabilities of our Materials and Solutions businesses to help our customers optimize labor efficiency and supply chain effectiveness, reduce waste, advance circularity and transparency, and better connect brands with consumers.

4 | ||||

Effectively allocate capital effectively by balancing investmentsand relentlessly focus on productivity

We balance our capital investment in organic growth, productivity, and acquisitions and venture investments, while returningcontinuing to return cash to stockholders.stockholders through dividends and share repurchases and ensure that we maintain a strong balance sheet with ample capacity to invest. In addition, we take actions to restructure our operations from time to time and use product reengineering and enterprise lean sigma principles to expand our margins, enhance our competitiveness and provide a funding source for reinvestment.

FINANCIAL PERFORMANCE HIGHLIGHTS

| • | In 2023, we invested $285.1 million in fixed and information technology (IT) capital expenditures to support organic growth; completed three acquisitions and made one venture investment for a total of $224.9 million; increased our quarterly dividend rate by ~8%; and repurchased $137.5 million in shares of our common stock. We also delivered ~$69 million in pre-tax savings from restructuring actions, net of transition costs. |

Avery Dennison Corporation | 2024 Proxy Statement | 3 |

5 | ||||

Lead in an environmentally and socially responsible manner

Strong Financial Performance

We aim to advance the environmental sustainability of our company and Executionvalue chain by delivering innovations that advance the circular economy, reducing the environmental impact of Strategic Priorities. Fiscal year 2017 marked our sixth consecutive year of strong top-lineoperations, and offering value-creation opportunities for our customers. We also seek to make a positive social sustainability impact by building a more diverse workforce and inclusive and equitable culture, maintaining operations that promote health and safety, and supporting our communities.

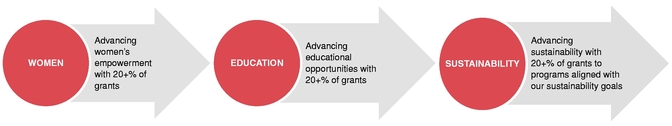

| • | In 2023, we made further progress toward our 2025 and 2030 sustainability goals, reducing the environmental impact of our operations and continuing to invest in our sustainability strategic innovation platform focused, among other things, on material circularity and waste reduction/elimination; driving sustainable change in diversity, equity and inclusion (DEI); and providing $5.5 million in support for our communities, primarily through the Avery Dennison Foundation (ADF). |

With these strategies in mind, our near-term priorities are to deliver on our high-value growth margin expansion and double-digit adjusted earnings per share (EPS) growth. We exceededinitiatives; achieve our financial goalsobjectives for the first half of the year; deepen our ecosystem engagement and expand our M&A pipeline; accelerate sustainability-related and digital innovation; and expand organizational capability in both Materials and Solutions.

PERFORMANCE HIGHLIGHTS

2023 Performance

Although a lower demand environment driven primarily by significant inventory destocking downstream from our company led to a challenging 2023, we delivered sequential improvement each quarter during the year and continued advancement in key growth areas such as Intelligent Labels. Market conditions were significantly worse than we initially anticipated, which resulted in our not realizing our annual performance expectations. Demonstrating strength and resiliency, we navigated the challenging environment, protecting margins; improving service for our customers; deepening our insights into the drivers of demand and inventory throughout our value chain; continuing to shift our product portfolio toward high-value categories, particularly Intelligent Labels; and generating strong cash flow. By leveraging our core strengths of productivity, cost management and capital stewardship and expanding our potential in intelligent label solutions, we mitigated the impact of the lower volume environment on our bottom line.

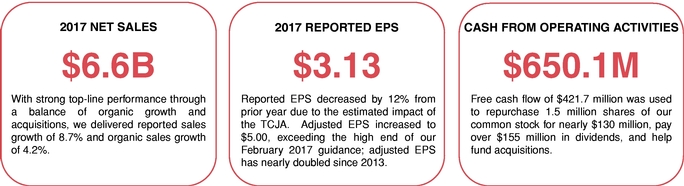

Key financial results for the year with the accomplishmentsare shown below and on the following page.below.

•Achieved net sales of approximately $6.6 billion, an increase of 8.7% over the prior year, through a balance of organic growth and acquisitions.•• Net sales of $8.4 billion, down 7.5% from $9.0 billion in 2022, reflecting lower volume primarily as a result of inventory destocking

Excluding the impact of currency, sales

grew by 8.2%; on an organic basis, sales grew by 4.2%, driven by growth in high value product categories and businesses serving emerging markets.declined 6.9%Avery Dennison Corporation|2018 Proxy Statement|i• Reported earnings per share (EPS) decreased from $9.21 in 2022 to $6.20 in 2023

•Although reportedAdjusted EPS decreased 13.7% from

$3.54 in 2016$9.15 to$3.13 in 2017 due to a substantial increase in our provision for income taxes to reflect$7.90, primarily reflecting lower volume, partially offset by productivity and restructuring actions

• With net cash provided by operating activities of $826.0 million, delivered adjusted free cash flow of $591.9 million; adjusted free cash flow conversion, meaning the proportion of net income we were able to convert to cash, was more than 100%

• On net income of $503.0 million, achieved return on total capital (ROTC) of 12.4%

4

2024 Proxy Statement | Avery Dennison Corporation

Sales change excluding the provisional estimated impact of the Tax Cuts and Jobs Act (TCJA)currency (sales change ex. currency), adjusted EPS, increased from $4.02 to $5.00, significantly exceeding the high end of the $4.30-$4.50 guidance range we gave in February 2017.

Organic sales growth, adjusted EPS, free cash flow, ROTCamortization (EBITDA) and adjusted ROTCEBITDA margin, which are used later in this proxy statement – are supplemental non-GAAP financial measures that we use internally and provide to investors to assist theminvestors in assessing our performance, and operating trends and defineliquidity. These measures are defined, qualified and reconciled from generally accepted accounting principles in theCompensation Discussion and Analysis section United States of America (GAAP) in Appendix A of this proxy statement. These non-GAAP financial measures are not in accordance with, nor are they a substitute for or superior to the comparable financial measures under generally accepted accounting principles in the United States of America (GAAP) and are reconciled to GAAP inAppendix A of this proxy statement.GAAP.

On Track to Deliver Financial Targets. Our 2014-2018 financial goals included an organic sales growth target of 4% to 5%, reflecting confidence in the trajectoryThe fundamentals of our two largest businesses. business shown below continue to provide us with significant competitive advantage.

We also targeted double-digit adjusted EPS growth. Forare exposed to diverse and growing end markets, with catalysts for long-term growth

We are industry leaders in our primary businesses, with strength in scale and innovation

We have a clear set of strategies that have been key to our success over the first time,long term across a wide range of business cycles

We are uniquely positioned to connect the physical and digital to help address some of the most complex problems facing the industries we externally communicated a target for ROTC, which has long been a key internalserve

Progress Toward 2025 Financial Targets

In March 2021, we announced financial metric fortargets through 2025. Given the challenges we experienced in 2023, our company. progress toward these long-term targets slowed during the year; however, we expect significant progress in 2024 as label and apparel markets rebound and growth in our Intelligent Labels business accelerates. We believe that the combinationour strategies, together with our team’s ability to execute in various environments, will allow us to continue generating long-term value creation through a balance of ourGDP+ growth and ROTC targets capturesstrong returns, as we unlock significant growth opportunities and our value creation objectives, which together arecore businesses rebound.

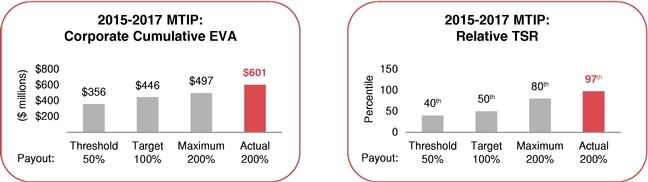

In 2021-2023, on a proxy for economic value added (EVA)three-year compound annual basis (with 2020 as the base period), one of the performance objectives usedGAAP reported net sales increased by 6.3%, while GAAP operating income, net income and EPS decreased by 1.1%, 3.3% and 2.1%, respectively. GAAP reported operating margin in our long-term incentive (LTI) compensation program. As shown below, based on our results for the first four years of this five-year period, we are on track to achieve or exceed our 2018 commitments to investors.2023 was 9.4%.

|

| 2021-2025 Targets | 2021-2023 Results(1) | ||

Sales Change Ex. Currency(2) | 5%+ | 7.7% | ||

Adjusted EBITDA Growth(2)(3) | 6.5% | 5.7% | ||

Adjusted EBITDA Margin | 16%+ in 2025 | 15.1% in 2023 | ||

Adjusted EPS Growth(2) | 10% | 3.6% | ||

ROTC | 18%+ | 12.4% in 2023 | ||

(1) | Results for non-GAAP measures are reconciled from GAAP in Appendix A of this proxy statement. | ||||||

Percentages for | |||||||

Avery Dennison Corporation| 2018 Proxy Statement |ii

In March 2017, we announced our 2017-2021 goals, targeting continued solid organic sales growth and double-digit growth in adjusted EPS on a compound annual basis. While we are only one year into this five-year period, we are on pace to deliver these targets, as shown below.

Percentages for | ||||||||

| (3) | Although adjusted EBITDA growth was not one of |

Reported results for these periods are disclosed in theCompensation Discussion and Analysis section of this proxy statement.Effective Capital Allocation

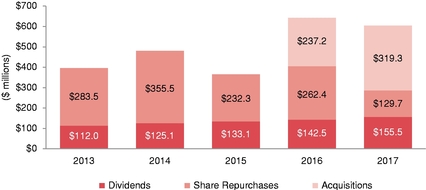

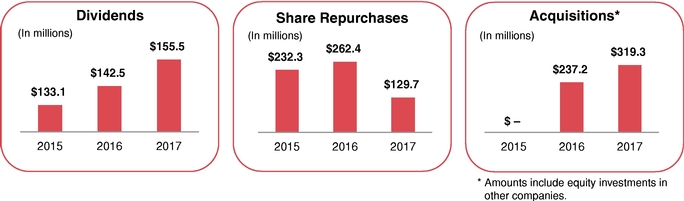

Disciplined Capital Allocation. Effectively deploying capital is one of our key strategies, and we have been consistently disciplined in our execution by investing in organic growth and productivity and acquiring targeted companies, while continuing to return cash to stockholders through dividends and share repurchases.

We have paid quarterly dividends for decades and raised our quarterly dividend rate by 125% since 2010. As shown in the graph below, over the last five years, we have allocated nearly $2 billion to dividends and share repurchases. Given our increased use of available capital for acquisitions and equity investments, we repurchased fewer shares in 2017 compared to prior years.

We have also allocated capital to investinginvested in our businesses to support organic growth and pursuing targeted acquisitionsacquired companies that supportexpand our strategycapabilities in high-value product categories, increase our pace of increasinginnovation and advance our exposuresustainability priorities. Our fixed and IT capital spending in 2023 of $285.1 million was comparable to high value product categories. 2022, reflecting our continued investment in high-value categories, particularly our Intelligent Labels business. During 2017,the year, we successfully completedacquired Thermopatch, Inc. (“Thermopatch”), a New York-based manufacturer specializing in labeling, embellishments and integratedtransfers for the acquisitions of (i) Hanita Coatings Rural Cooperative Association Limited, an Israel-based pressure-sensitivesports, industrial laundry, workwear and hospitality industries; LG Group, Inc. (“Lion Brothers”), a Maryland-based designer and manufacturer of specialty filmsapparel brand embellishments; and laminates; (ii) Yongle Tape Ltd.Silver Crystal Group (“Silver Crystal”), a China-based manufacturerCanada-based provider of specialty tapessports apparel customizations and related products usedapplication solutions across in-venue,direct-to-business and e-commerce platforms; together, these acquisitions expand the external embellishments portfolio in a variety of industrial markets; and (iii) Finesse Medical Limited, an Ireland-based manufacturer of healthcare products used in the management of wound care and skin conditions.our Solutions Group. We also made equity investmentsone venture investment in two other companies.a company developing technological solutions that we believe have the potential to advance our strategies.

Capital Allocated to Dividends,Share RepurchasesIn 2023, we paid $256.7 million in dividends of $3.18 per share and Acquisitions*

* Amounts for acquisitions include equity investments in other companies.

Avery Dennison Corporation | 2024 Proxy Statement | 5 |

Avery Dennison Corporation| 2018 Proxy Statement |iii

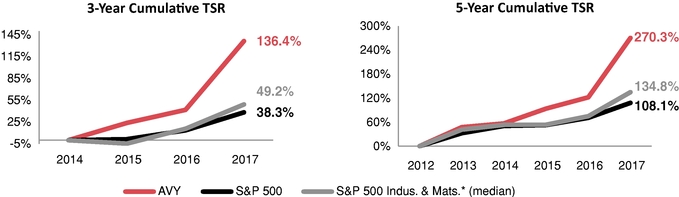

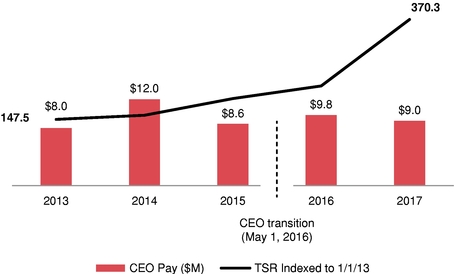

Three- and Five-Year Cumulative TSR Outperformance.As shown below, with total stockholder returnover the last five years, we have deployed over $2 billion to acquisitions (including venture investments) and returned over $2 billion to stockholders in dividends and share repurchases.

|

|  |

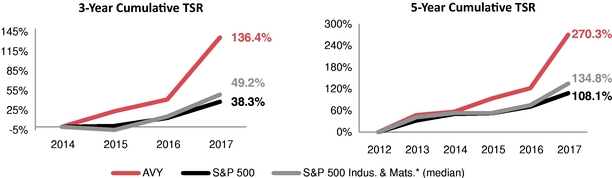

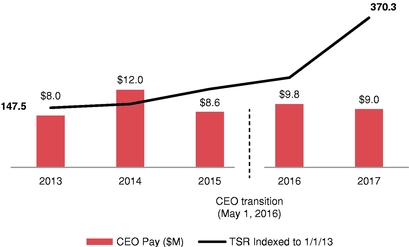

Longer-Term Total Stockholder Return (TSR) of over 66%Outperformance

Our TSR in 2017, we delivered cumulative2023 was modestly below the TSR for the 2015-2017 three-year period and the 2013-2017 five-year period that significantly outperformed the S&P 500® and the median of the S&P 500 Index and the S&P 500 Industrials Index and Materials subsets (wemodestly above the Dow Jones U.S. Container & Packaging Index, three comparator groups we use to assess our relative performance. In 2023, we disaggregated our market basket comparator group used in previous years into the S&P 500 Industrials Index and the Dow Jones U.S. Container & Packaging Index, of which we are a member of the Materials subset, but also share many characteristics with members of the Industrials subset; investors have informed us that they look at both subsets in evaluatingmember. We believe this presentation provides greater clarity on our relative performance, as we do internally).reflecting it in a manner more consistent with the methodology used by peer companies.

We believe that our longer-term TSR measures the return we have providedis a more meaningful measure than our one-year TSR, which can be impacted by short-term market volatility unrelated to our stockholders,performance. Our five-year cumulative TSR significantly outperformed all three of these comparator groups.

5-YEAR CUMULATIVE TSR |

1-, 3- AND 5-YEAR TSR |

| AVY | S&P 500 Index | S&P 500 Industrials Index | Dow Jones U.S. Container & | |||||

2019 | 49% | 31% | 29% | 29% | ||||

2020 | 21% | 18% | 11% | 21% | ||||

2021 | 41% | 29% | 21% | 11% | ||||

2022 | (15)% | (18)% | (5)% | (18)% | ||||

2023 | 14% | 26% | 18% | 8% | ||||

3-Year TSR | 37% | 33% | 35% | (2)% | ||||

5-Year TSR | 145% | 107% | 94% | 53% | ||||

LEADERSHIP TRANSITION

| EXECUTIVE CHAIRMAN | PRESIDENT/CEO | |||

|

| |||

Mitch Butier | Deon Stander |

In May 2023, Mitch Butier announced his decision to step down as our CEO. Our Board elected Mr. Butier as Executive Chairman effective September 1, 2023 to ensure a smooth transition by providing counsel and guidance to our new CEO, noting that, during his tenure as CEO, our company delivered superior performance while creating even greater future potential, accelerated growth and expanded margins, and advanced our sustainability priorities.

6 | 2024 Proxy Statement | Avery Dennison Corporation |

Our Board has a well-established CEO succession planning process that is part of its broader ongoing leadership succession planning. Reflecting a thoughtful succession process, in May 2023 our Board elected Deon Stander as President/CEO, effective September 1, 2023. Mr. Stander had been our President/Chief Operating Officer (COO) since March 2022, after having served as Vice President/General Manager of our business now known as Solutions Group since June 2015. Having evaluated his attributes, experiences and strengths as a leader during multiple discussions over the preceding 18-24 months, our Board determined that Mr. Stander, who has served in a number of leadership roles across the globe with increasing responsibility and impact during his 20-year career with our company, was the right individual to lead our company into the future. Mr. Stander has a proven track record, including stock price appreciationleading the transformation of our Solutions business and dividends paid (assuming reinvestment thereof).helping accelerate growth in Intelligent Labels.

1-, 3- and 5-YEAR TSR | ||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 3-Year TSR | 5-Year TSR | ||||||||

| | | | | | | | | | | | | | | |

AVY | 47.5% | 6.2% | 23.8% | 14.6% | 66.7% | 136.4% | 270.3% | |||||||

| | | | | | | | | | | | | | | |

S&P 500 | 32.4% | 13.7% | 1.4% | 12.0% | 21.8% | 38.3% | 108.1% | |||||||

| | | | | | | | | | | | | | | |

S&P 500 Indus. & Mats.* (median) | 41.0% | 11.7% | (4.7)% | 19.0% | 27.5% | 49.2% | 134.8% | |||||||

*Based on companies in subsets asIn connection with their transitions to these respective roles, giving consideration to the advice ofDecember 31, 2017.

Avery Dennison Corporation| 2018 Proxy Statement |iv

Tableits independent compensation consultant, WTW, our Board’s Talent and Compensation Committee (the “Compensation Committee”) made the decisions described below related to the compensation of ContentsMessrs. Stander and Butier.

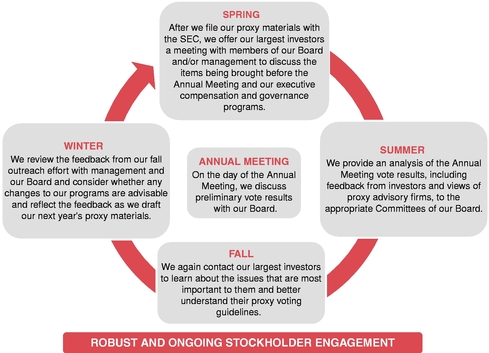

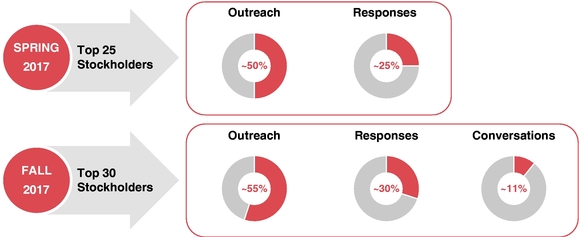

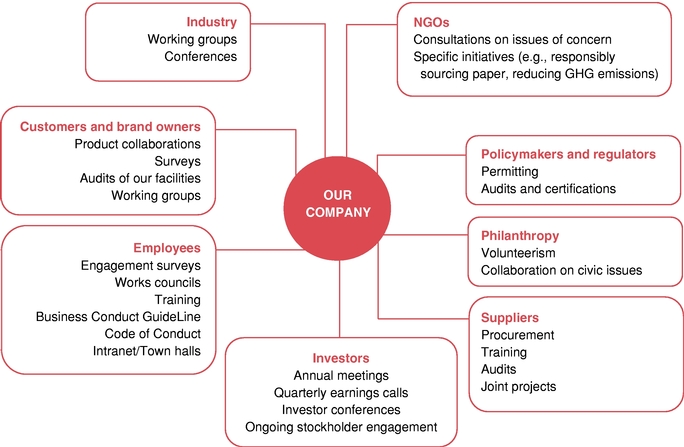

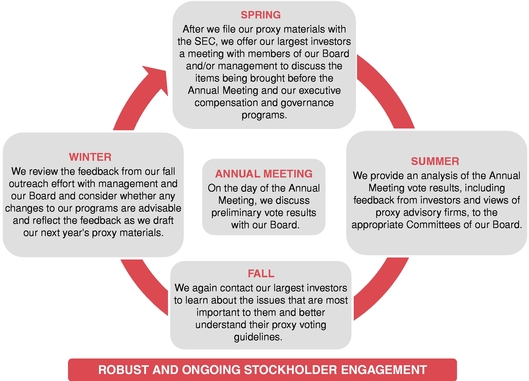

We continued our longstanding practiceFor Mr. Stander, increased his annual base salary from $700,000 to $1.1 million and his target Annual Incentive Plan (AIP) opportunity from 75% to 135% of ongoing engagement and open dialoguebase salary, in each case effective September 1, 2023. The Compensation Committee preliminarily aligned to increase his target long-term incentive (LTI) opportunity from 300% to 550% of base salary, effective with stockholders in 2017. Our engagement program takes place throughout the year, generally as shown below.

ENGAGEMENT PROCESS

annual LTI award on March 1, 2024, subject to its review of market pay for similar roles at that time. In advanceaddition, the Compensation Committee approved a special promotion award of stock options on September 1, 2023 with a grant date fair value of approximately $3 million, 50% of which vests on each of the 2017 Annual Meeting, we contactedthird and fourth anniversaries of the grant date, in each case subject to his continued service.

For Mr. Butier, reduced his annual base salary from $1.3 million to $1 million and his target AIP opportunity from 160% to 120% of base salary, in each case effective September 1, 2023. He received no special LTI award in connection with his role change.

2024 DIRECTOR NOMINEES (ITEM 1)

As previously disclosed, in February 2024, Julia Stewart notified our 25 largest institutional stockholders, representing almost 50%Board of our then-outstanding shares. Board members, including our Lead Independent Director, and management were made availableher intention not to answer questions and address concerns regarding our executive compensation and governance programs and the items being brought to stockholder votestand for reelection at the Annual Meeting. While we received responses from stockholders representing 25%As a result, her membership on our Board will end on the date of the Annual Meeting.

Board Performance Highlights

Our Board provides strong oversight of our then-outstanding shares, nonemanagement team and company, with highlights of them feltits accomplishments in recent years described below.

Supported management in navigating our response to the pandemic, including related labor, freight and inflationary challenges, in 2020 and 2021; pandemic-related challenges in China, the Russia-Ukraine war, supply chain disruptions, sizable currency movements and inflationary pressures in 2022; and lower demand driven primarily by downstream inventory destocking in 2023

Oversaw management’s consistent execution of our strategies, delivering performance that there wasexceeded our 2021 financial targets and progressed us toward achieving our 2025 financial targets, as well as 2019-2023 TSR of 145%, significantly outperforming the S&P 500 Index, S&P 500 Industrials Index and Dow Jones U.S. Container & Packaging Index

Supported management in evaluating synergistic acquisition targets, resulting in 15 companies becoming part of our portfolio, adding new capabilities, expanding our position in high-value product categories and enhancing our opportunities in the marketplace

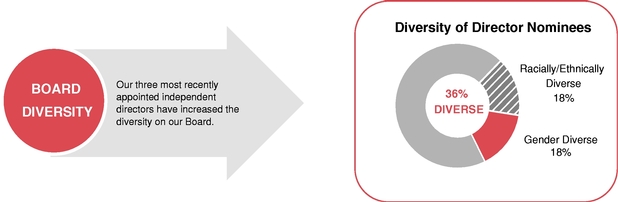

Implemented thoughtful Board refreshment and director succession planning to ensure we maintain a needhigh-caliber Board; mitigate the potential impact of concentrated mandatory retirements given the closeness in age of many of our directors; and further enhance overall Board diversity, leading to substantively engage during that busy time.the appointment of three new independent directors in the last 18 months, two of whom increased the gender and/or ethnic diversity on our Board

Conducted regular executive succession planning, resulting in experienced leaders promoted to more senior positions, including our new CEO and Solutions Group President, each appointed in 2023

Sharpened focus on advancing our sustainability agenda, with continuous progress toward achieving our 2025 sustainability goals and more ambitious 2030 goals, as well as enhanced sustainability reporting

Avery Dennison Corporation | 2024 Proxy Statement | 7 |

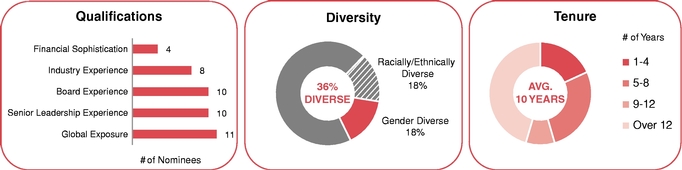

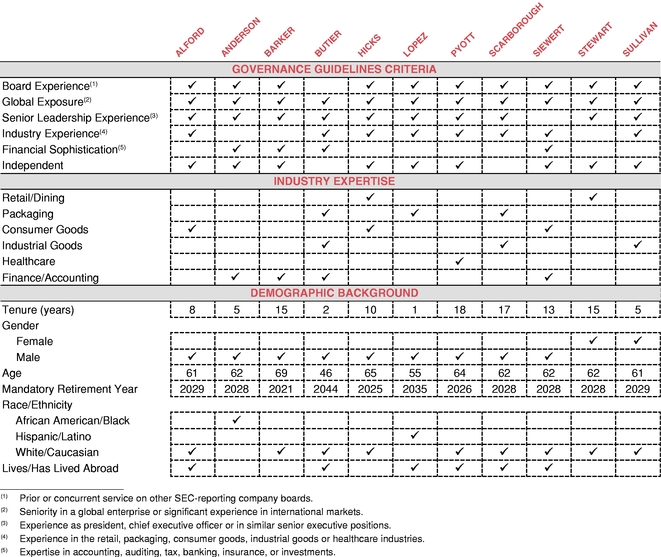

Matrix of Director Nominee Skills, Qualifications and Demographic Backgrounds

Our director nominees bring a balance of skills, qualifications and demographic backgrounds to their roles in providing oversight of our company, as shown by individual in the matrix below. This matrix, which has been revised and expanded from previous years to, among other things, specify key areas of industry and functional experience or expertise, reflects additional information we solicited from directors in our year-end 2023 questionnaire.

In

As part of its ongoing director succession planning process, the fall, without the time pressures associated with proxy season, we reached outGovernance Committee regularly discussed and reported to our 30 largest institutional stockholders, representing nearly 55%Board during 2023 on the skills, qualifications and demographic backgrounds desirable for our Board to best serve the needs of our then-outstanding shares. Proposed topicscompany. As part of this process, the Governance Committee initiated a search for these meetings includednew directors with retail/consumer packaged goods (CPG) or finance expertise, which led to the appointment of Maria Fernanda Mejia to our business strategyBoard in February 2024. The search for an independent director with finance expertise continues and financial performance, executive compensation matters, is expected to conclude in the coming months.

8 | 2024 Proxy Statement | Avery Dennison Corporation |

DIRECTOR NOMINEE MATRIX

|

| Initial Criteria | ||||||||||||||||||||

Independent(1) | ✓ | ✓ |

| ✓ | ✓ | ✓ | ✓ |

| ✓ | ✓ | ||||||||||

Public Company Leadership Exp.(2) | ✓ |

| ✓ |

| ✓ |

| ✓ | ✓ |

| ✓ | ||||||||||

Public Company Board Exp.(3) |

| ✓ |

|

| ✓ | ✓ |

|

| ✓ | ✓ | ||||||||||

| Industry Experience(4) | ||||||||||||||||||||

Digital/Technology |

|

| ● |

| ● |

| ● | ● |

| ● | ||||||||||

Retail |

| ● | ● |

| ● | ● |

| ● | ● |

| ||||||||||

Consumer Goods |

| ● |

|

| ● | ● |

|

| ● | ● | ||||||||||

Packaging | ● | ● | ● | ● | ● | ● |

| ● | ● |

| ||||||||||

Materials Science | ● |

| ● | ● |

|

| ● | ● | ● |

| ||||||||||

Industrial Goods | ● |

| ● | ● |

|

| ● | ● | ● |

| ||||||||||

| Functional Experience(4) | ||||||||||||||||||||

Finance | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

Marketing | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

M&A | ● | ● | ● |

| ● | ● | ● | ● | ● | ● | ||||||||||

Environmental Sustainability | ● |

| ● | ● | ● | ● | ● | ● | ● |

| ||||||||||

Cybersecurity | ● |

| ● |

| ● |

| ● | ● | ● | ● | ||||||||||

Science/Engineering/R&D | ● | ● | ● | ● |

| ● | ● | ● | ● | ● | ||||||||||

| Demographic Background(5) | ||||||||||||||||||||

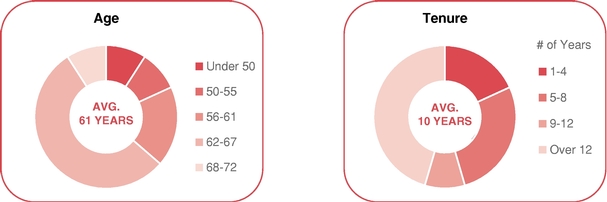

Tenure (years as of YE 2023) | 63⁄4 | 133⁄4 | <1 | 3⁄4 | 161⁄2 | – | 103⁄4 | 73⁄4 | 183⁄4 | 11⁄4 | ||||||||||

Gender |

|

|

|

|

|

|

|

|

|

| ||||||||||

Woman |

|

|

| ✓ |

| ✓ | ✓ |

|

|

| ||||||||||

Man | ✓ | ✓ | ✓ |

| ✓ |

|

| ✓ | ✓ | ✓ | ||||||||||

Non-Binary |

|

|

|

|

|

|

|

|

|

| ||||||||||

Age | 61 | 67 | 55 | 52 | 71 | 60 | 67 | 52 | 68 | 57 | ||||||||||

Mandatory Retirement Year | 2035 | 2029 | 2041 | 2044 | 2025 | 2036 | 2029 | 2044 | 2028 | 2039 | ||||||||||

Race/Ethnicity |

|

|

|

|

|

|

|

|

|

| ||||||||||

Black or African American |

|

|

|

|

|

|

|

|

|

| ||||||||||

Hispanic or Latino | ✓ |

|

|

|

| ✓ |

|

|

|

| ||||||||||

White | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

Asian (including South Asian) |

|

|

|

|

|

|

|

|

|

| ||||||||||

Native Hawaiian or Pacific Islander |

|

|

|

|

|

|

|

|

|

| ||||||||||

Native American or Alaska Native |

|

|

|

| ✓ |

|

|

|

|

| ||||||||||

LGBTQ+ | ||||||||||||||||||||

Veteran |

|

|

|

| ✓ |

|

|

|

|

| ||||||||||

Works/Worked Outside U.S. | ✓ | ✓ | ✓ | ✓ |

| ✓ |

| ✓ | ✓ |

| ||||||||||

| (1) | Determined by our Board as independent under NYSE listing standards. |

| (2) | Service as U.S. public company CEO, COO and/or CFO. |

| (3) | Prior or concurrent service on another U.S. public company board excluding companies at which individual served or serves as CEO, COO and/or CFO. |

| (4) | Key for industry and functional experience: |

| • | Technical expertise – Direct management experience or subject matter expertise during professional career. |

| • | Supervisory experience – Supervisory management experience during professional career. |

| • | Substantial knowledge – Knowledge from serving on board of another U.S. public company and/or gained from investment banking or private equity experience. |

| (5) | Classifications for gender, race/ethnicity, LGBTQ+, veteran and works/worked outside the U.S. based on directors’ responses to questionnaire. |

Avery Dennison Corporation | 2024 Proxy Statement | 9 |

Board composition andGovernance Highlights

Highlights of our governance program are shown below.

Stockholder Rights | ✓ Market-standard proxy access ✓ If Item 3 is approved at Annual Meeting, stockholders will have the right to request that we call special meetings of stockholders at 25% ownership threshold ✓ No supermajority voting requirements ✓ No poison pill ✓ No exclusive forum or fee-shifting bylaws | |

Board Governance | ✓ Annual election of directors ✓ Majority voting in director elections ✓ Single class of outstanding voting stock ✓ Director nominees 80% independent ✓ Robust Lead Independent Director role ✓ Regular director succession planning and paced Board refreshment, including four new directors appointed within last 18 months ✓ Continuous executive succession planning and leadership development ✓ Annual Board/Committee evaluations and individual director feedback process ✓ Mandatory director retirement policy at age 72 with no exemptions or waivers allowed or granted ✓ Best practice Governance Guidelines ✓ Strong Board and Committee governance ✓ Direct access to management and experts |

SUSTAINABILITY

We have been consistently focused on advancing our sustainability agenda by establishing our priorities, setting ambitious goals and making consistent progress toward their achievement. Our sustainability progress reflects the leadership of our management team and the engagement and oversight of our Board, as well as the commitment and passion of our team members worldwide.

Sustainability Governance

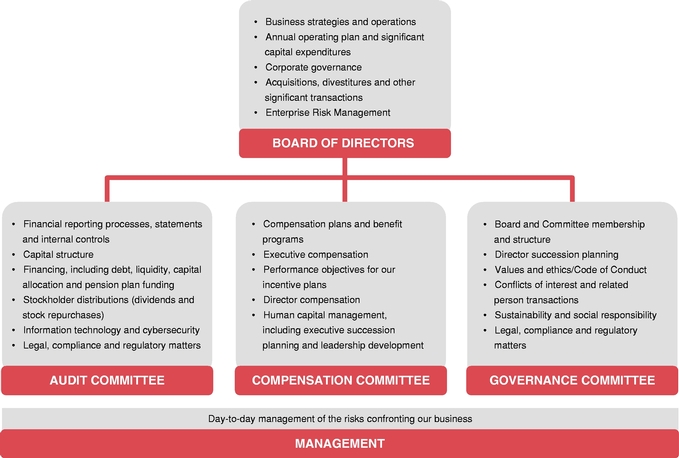

We believe that strong sustainability governance ensures consistency and accuracy of information we use to provide transparency to our stakeholders. Our governance structure is shown below.

| SUSTAINABILITY GOVERNANCE STRUCTURE |

10 | 2024 Proxy Statement | Avery Dennison Corporation |

Sustainability Data and Reporting

We continue to refine and expand the sustainability data we disclose, which has provided our stakeholders with regular insight into our progress. Our sustainability data is indexed to the Sustainability Accounting Standards Board (SASB) and Global Reporting Initiative (GRI) frameworks to facilitate comparability of our results with those of other companies. We partnered with a third-party expert to assess our disclosures against the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) regarding the information that companies should disclose to allow their stakeholders to assess and price their climate-related risks and have developed a plan to align with TCFD requirements.We also report to Carbon Disclosure Project (CDP) Climate, Water and Forests and support the growing adoption of International Sustainability Standards Board (ISSB) standards. We plan to assess our reporting against ISSB standards, and other disclosures that incorporate those standards, as part of our ongoing sustainability reporting transparency efforts.

Our sustainability teams assess our reporting in accordance with external frameworks; engage with environmental, social and governance (ESG) rating agencies; manage our data collection and reporting processes; establish and monitor assurance guidance and controls; and approve reports, data and information. In addition, we engage an independent third party to validate our energy and greenhouse gas (GHG) emissions data. Having aligned with the Audit Committee to ensure Board oversight of sustainability governance, our reporting processes ensure data owner sign-off, Sustainability Disclosure Committee review and senior management approval prior to publication.

Our March 2024 ESG Download, being made available on our website at esg.averydennison.com on or before the filing of our definitive proxy statement, reflects our focus and progress towards achievingon sustainability and governance matters. It includes ~140 metrics covering our policies, goals, strategies, risks, outcomes and certifications. Information on our website is not and should not be considered part of, nor is it incorporated by reference into, this proxy statement.

Sustainability Progress

Sustainability is one of our core values and has long been integral to our way of doing business. To create value for all our stakeholders, we are advancing our sustainability goals. We received responses from stockholders representing over 30% ofstrategic innovation platform focused, among other things, on material circularity and waste reduction/elimination; building a more diverse workforce and inclusive and equitable culture; maintaining operations that promote health and safety; and supporting our then-outstanding shares and spoke with stockholders representing approximately 11% of those shares. We substantively engaged with every stockholder who requested to do so.

Avery Dennison Corporation| 2018 Proxy Statement |v

The graphics below show the results of our 2017 engagement.

STOCKHOLDER FEEDBACK DURING 2017 ENGAGEMENT

Governance Matters

With respect to matters related to governance, we discussed several topics related to our Board's processes, including succession planning and refreshment, diversity, and evaluations. We also discussed the integration ofcommunities. Integrating sustainability into our business strategies and our Board's oversight of our cybersecurity preparedness. Our stockholders expressed interest in the anticipated completion of our CEO transition and our Board's views on proxy access; both of these matters were subsequently addressed with our December 2017 announcement of Dean Scarborough's retirement as our Executive Chairman at the end of that year and our adoption of proxy access.

Executive Compensation Matters

With respect to matters related to executive compensation, our stockholders expressed support for our program generally and appreciated the more graphical disclosure in our 2017 proxy statement. In addition, we discussed our approach to human capital management, in particular our diversity and inclusion efforts, as well as the linkage between our executive incentive compensation and business strategies. We also provided additional clarification on the market-leveraged stock units (MSUs) included in our LTI program.

Our Board and management believe that ongoing stockholder engagement fosters a deeper understanding of investors' evolving expectations on compensation and governance matters. We look forward to maintaining our longstanding practice of connecting with stockholders to ensure our programs continue to align with best practices.

Avery Dennison Corporation| 2018 Proxy Statement |vi

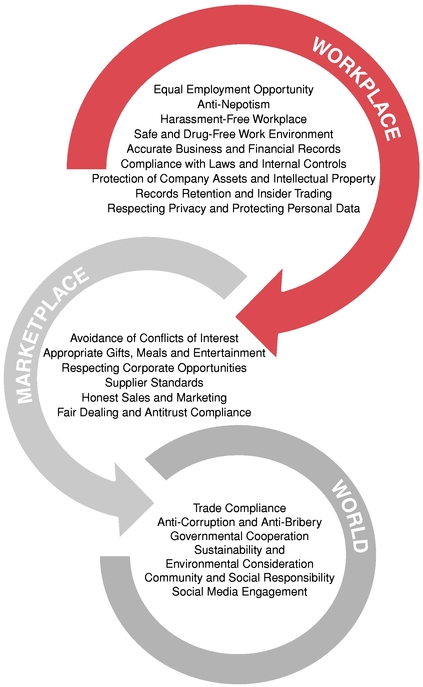

Sustainability is one of our values and has long been part of our approach to doing business. Our aim is to improve the sustainability of our products and processes while helping to create shared value for all of our stakeholders. Key to our progress has been integrating sustainability into our underlying business strategies and engaginghelped us engage employees at all levels.levels to deliver sustained progress.

We report

Avery Dennison Corporation | 2024 Proxy Statement | 11 |

In the first eight years of the 10-year horizon for our 2025 sustainability goals, we have made substantial progress, including exceeding our goal for cumulative GHG emissions reduction, as shown in the scorecard below. You can find additional information on our sustainability progress every two years. In September 2017, we issuedin our 2014-2016 Sustainability2023 Integrated Report summarizingbeing furnished to the Securities and Exchange Commission (SEC) prior to the distribution of our key achievements during the period and progress towards reaching the 2025 sustainability goals we setproxy materials, as well as in 2015. We encourage you to review the report on our website atwww.averydennison.com/sustainability. Our sustainability goals are shown below and our progress is described underSustainability in theGovernance, Sustainability and Social Responsibility section of this proxy statement.March 2024 ESG Download.

| 2023 SCORECARD OF PROGRESS TOWARD 2025 SUSTAINABILITY GOALS | |||||||||||

| Goal(s) | Baseline Year | Highlights of Progress | ||||||||

Greenhouse Gas Emissions

| Achieve at least 3% absolute reduction | 2015 | Reduced GHG emissions by additional ~7% in 12 months through Q3 2023, our most recently available data, compared to same period in prior year and by ~63% cumulatively through Q3 2023 compared to baseline year | ||||||||

Paper

| Source 100% certified paper, of which at least 70% | 2015 | Of total volume of paper procured in 2023, ~96% was certified, with ~79% of face stock Forest Stewardship Council®-certified | ||||||||

Films

| 70% of | N/A | ~97% of 2023 film volume conformed to Materials Group’s Restricted Substance List (RSL) | ||||||||

Chemicals

| 70% of | N/A | ~96% of 2023 chemical volume conformed to Materials Group’s RSL | ||||||||

| Products and Solutions

| Derive 70% of revenues from sustainability-driven products (as defined by our Sustainable ADvantage criteria) | 2015 | ~67% of Materials Group (based only on Label and

| |||||||

Waste

| Be 95% landfill-free, with at least 75% of our waste reused, repurposed or |

2015 | Diverted ~93% of | ||||||||

People

| Continue to cultivate diverse (40%+ female at level of manager and above), engaged, safe (recordable incident rate (RIR) of <0.25), productive and healthy workforce Maintain world-class safety and employee engagement scores | 2015 | Increased female representation at level of manager and above by ~4% from baseline year, reaching ~36% at YE 2023 Continued world-class safety record, with RIR of 0.22 in 2023, substantially better than manufacturing industry average of 3.2 in 2022 (most recently available data) Employee engagement of ~80%* in 2023 | ||||||||

Transparency

| Commit to goals publicly and be transparent in reporting progress | N/A | Continued enhancing sustainability transparency with more comprehensive reporting, including in our | ||||||||

| * | Data reflects change in engagement survey platform and methodology. |

12 | 2024 Proxy Statement | Avery Dennison Corporation |

After completing our biannual materiality assessment in 2020 to prioritize the most significant environmental and social sustainability challenges then facing our company and our stakeholders, we established an additional set of sustainability goals that we are aiming to achieve by 2030. Within these goals, we have specific targets. In 2022, we completed an enhanced materiality assessment, which included an updated mapping of our sustainability priorities throughout our value chain. This process included interviews with internal and external stakeholders such as members of management, customers and non-governmental organizations (NGOs), as well as industry analysis. The topics that ranked highest in the assessment also offer substantial value-creation opportunities for our company and customers. The most material topics identified in our 2022 materiality assessment – transition to a circular economy, advanced technologies and innovation, climate change, GHG emissions and reduction, supply chain, fair and inclusive marketplace, materials management and operational waste – are all reflected in our 2030 sustainability goals and targets. Our progress toward our 2030 goals through 2023 is shown below.

| ||||||

Goal | Targets | Baseline Year | Highlights of Progress | |||

Deliver innovations that advance the circular economy | Satisfy the | |||||

Solutions Group: 100% of |

N/A | ~75% (based only on Apparel Solutions) | ||||

Materials Group: 100% of our standard label products will contain recycled or renewable content; all of our regions will have labels that enable circularity of plastics | N/A | ~61% (based only on Label and Graphic Materials) | ||||

Reduce the environmental impact in our operations and supply chain | Reduce our Scope 1 and 2 GHG emissions by 70% from our 2015 baseline. Work with our supply chain to reduce our 2018 baseline Scope 3 GHG emissions by 30%, with an ambition of net zero by 2050 | N/A | Scope 1 and 2: ~63%; as of Q3 2023, our most recently available data Scope 3: Prior-year calculations publicly available in our most recent CDP Climate response* | |||

Source 100% of paper fiber from certified sources focused on a deforestation-free future | 2015 | ~96% certified | ||||

Divert 95% of our waste away from landfills, with a minimum of 80% of our waste recycled and the remainder either reused, composted or sent to energy recovery | 2015 | ~89% landfill-free ~64% recycled | ||||

Deliver a 15% increase in water efficiency at our sites that are located in high- or extremely high-risk countries as identified in the World Resources Institute Aqueduct Tool | N/A | ~9% as of Q3 2023 | ||||

Make a positive social impact by enhancing the livelihood of our people and communities | Foster an engaged team and an inclusive workplace • Inclusion Index: 85% • Employee Engagement: 82% • Females in manager level or above positions: 40% • Safety: RIR of 0.20 | 2015 | ~76%** (N/A in 2015) ~80%** (from 80%) ~36% (from 32%) 0.22 (from 0.31) | |||

Support the participation of our employees in ADF grants and foster the well-being of the communities in which we • 85% of countries in which we operate receive ADF grants • 50% of all ADF grants incorporate volunteerism | N/A | Made ADF grants in ~72% of countries in which we operate 95% of grants incorporated employee volunteerism | ||||

| * | Our Scope 3 GHG emissions reporting is currently spend-based and fluctuates with market trends and inflation. |

| ** | Data reflects change in engagement survey platform and methodology. |

Avery Dennison Corporation | 2024 Proxy Statement | 13 |

Avery Dennison Corporation| 2018 Proxy Statement |vii

Table of ContentsPEOPLE AND CULTURE

2018 DIRECTOR NOMINEES (ITEM 1)

Our Board has overseenemployee experience depends on our strong recent performance, includingculture, technology and work environment, whether in an office, remote or hybrid. To enhance this experience, we have advanced our professional-level onboarding and expanded digital access for our manufacturing and remote employees; enabled the following:

•Successful executioncontinuous growth of ourBoard-aligned business strategies,employee resource groups (ERGs), whichhas drivenare open to all employees; further enhanced flexible work arrangements; provided more targeted talent development programming; and matured ourstrong TSR performance over the most recent three-enterprise leader development program.We have continued annually evaluating pay equity, making adjustments where appropriate. In 2023, we reviewed pay equity (considering total base and

five-year periods of over 136% and 270%, respectively, in each case substantially outperforming the S&P 500;•The closing and integration of five acquisitions and the completion of equity investments in three other companies in the last two years, demonstrating our disciplined approachannual incentive compensation) with respect toacquisitions through which we target companies that can enhance our existing capabilities and increase our exposure to high value product categories; and•Seamless execution of our Board's executive succession planning with the 2016 election of Mitch Butier as our Chief Executive Officer (CEO), after serving as Chief Operating Officer under our previous CEO, Dean Scarborough (who then became our Executive Chairman),gender for all non-manufacturing employees globally, as well as all manufacturing employees in the2017 electionU.S. and certain other countries, and with respect to race/ethnicity for all U.S. employees. Our teams engaged with company leadership on our pay equity/transparency priorities and implemented several advancements, such as including employees from recently integrated acquisitions in our population data, expanding our analysis to include long-term incentives for director-level and above employees, and fine-tuning our analytic model in certain regions to reflect their unique circumstances. We also enhanced pay transparency to comply with evolving laws and regulations.Diversity is one of

Greg Lovinsour core values, reflecting our commitment to ensuring an inclusive and equitable environment for people of all backgrounds. It is our belief that we gain strength from diverse ideas and teams. Our DEI efforts are intended to foster an environment where our employees can grow and be increasingly productive and innovative, enhancing our reputation as a great place to work and allowing us to attract and retain talent for the benefit of our stakeholders. We hold ourselves accountable for our DEI progress in our 2030 sustainability goals. Over the past several years, we have significantly advanced our DEI journey, as shown below. Our 2023 EEO-1 statistics, which reflect the voluntary self-identification by our U.S. employees, can be found in our March 2024 ESG Download.HIGHLIGHTS OF DEI JOURNEY

2015

• Established goal of 40%+ female at manager level and above

• Employees established first ERG

2016-2020

• Added Diversity as one of our company values

• Established Regional DEI Councils

• Launched and expanded gender pay equity review and began evaluating U.S. racial/ethnic pay equity, in each case making adjustments where appropriate

• Began requiring gender-diverse hiring slates globally

• Conducted unconscious bias training for managers globally

• Added inclusion index to annual employee engagement survey

• Expanded flexible work arrangements

• Initiated Women.Empowered development program

• Joined CEO Action for Diversity & Inclusion

• Employees established several new ERGs, including for women and Black/African American, LGBTQ+ and Latinx employees

2021

• Formalized DEI strategy with four global pillars and supporting regional focus areas

• Established DEI infrastructure with global leader and dedicated regional resources

• Further enhanced pay equity review with third-party analysis of U.S. racial/ethnic data

• Began annually publishing EEO-1 statistics

• Reached milestone of 20+ ERGs, which are open to all our employees

• Implemented more equitable benefits for LGBTQ+ employees and their families

2022-2023

• Made additional progress in female manager+ representation; on track to reach 40% by 2026

• Improved global female employee engagement and maintained rate of female departures in manager+ positions despite competitive talent market

• Grew ERG membership globally by 30%+

• Launched AD Advocate, pairing executives to sponsor and mentor top diverse talent

• Implemented new employee engagement survey, providing expanded set of questions more reflective of market best practices, enhanced comparability with peers, improved analytics and pulse survey capability

• Completed foundational work focused on DEI strategic pillars of women leaders, fairness manufacturing, inclusion and underrepresented groups (from hiring to development and career growth)

In 2024, we plan to maintain our focus on fair and transparent talent practices and standards, equitable access to opportunities for career growth and development, and manufacturing team communication and camaraderie.

14

2024 Proxy Statement | Avery Dennison Corporation

STOCKHOLDER ENGAGEMENT

In addition to our ongoing investor relations program through which our CEO, Chief Financial Officer (CFO)., business leaders and Investor Relations team engage with our investors throughout the year, for over a decade, we have semiannually engaged with stockholders to solicit feedback on our strategies, executive compensation and sustainability progress, offering to include directors as participants in scheduled meetings. The objectives of this program are to maintain regular and thoughtful engagement to directly obtain investor feedback; continue to strengthen our relationships with key investors; and gather perspectives on our sustainability and governance profile to identify potential improvement opportunities. Our Board and management believe that ongoing stockholder engagement fosters a deeper understanding of evolving investor expectations and helps ensure we continue to reflect best practices.

APPOINTMENT OF NEW DIRECTOR2023 Engagement Results

Upon

2023 ENGAGEMENT RESULTS* | ||||||

| Outreach | Conversations | |||||

In 2023, we contacted our top 35 investors in proxy season and the off-season. Board members, in particular our Lead Independent Director (LID), and management were made available to answer questions and discuss matters of investor interest. We engaged with every stockholder who requested a meeting or accepted our invitation to meet, and our Lead Independent Director led the majority of our off-season engagements. | |  | |  | ||

| * | Based on percentage of shares outstanding. |

We discussed the recommendation ofresults and feedback from our 2023 engagement regarding executive compensation and social sustainability with the Compensation Committee and regarding governance and environmental sustainability with our Board’s Governance and Social Responsibility Committee,Committee. We also shared highlights with our Board appointed Andres Lopez as an independent director onto supplement the reports from those Committee Chairs.

In February 2024, giving consideration to the feedback we received from investors during our 2023 engagements, our Board effective February 1, 2017. Mr. Lopez brings deep packaging industry expertise as President and CEO of Owens-Illinois, Inc., after having served in leadership roles of increasing responsibility at the glass container manufacturing company (as described in greater detail in his biography on page 28 of this proxy statement). Mr. Lopez was subsequently electedapproved, subject to our Board by our stockholders at the 2017 Annual Meeting.

RETIREMENT OF EXECUTIVE CHAIRMAN

In December 2017, Mr. Scarborough, then Executive Chairman, notified the Board that he would be retiring from our company at the end of the year. He was our employee through December 31, 2017 and continues to serve as non-executive Chairman.

DIRECTOR NOMINEES

Our director nominees have demonstrated their commitment to diligently executing their fiduciary duties on behalf of our stockholders, and we recommend that our stockholders elect each of the nominees shown in the chart belowstockholder approval at the Annual Meeting.Meeting, a Certificate of Amendment to our Amended and Restated Articles of Incorporation to provide that stockholders holding 25% of our outstanding common stock have the right to request that we call special meetings of stockholders.

| NAME | AGE | DIRECTOR SINCE | PRINCIPAL OCCUPATION | INDEPENDENT | AC | CC | GC | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bradley A. Alford | 61 | 2010 | Retired Chairman & CEO, Nestlé USA | M | M | |||||||||

| Anthony K. Anderson | 62 | 2012 | Retired Vice Chair & Managing Partner, Ernst & Young LLP | M | M | |||||||||

| Peter K. Barker | 69 | 2003 | Retired Chairman of California, JPMorgan Chase & Co. | M | | C | ||||||||

| Mitchell R. Butier | 46 | 2016 | President & CEO, Avery Dennison Corporation | |||||||||||

| Ken C. Hicks | 65 | 2007 | Retired Chairman, Foot Locker, Inc. | M | M | | ||||||||

| Andres A. Lopez | 55 | 2017 | President & CEO, Owens-Illinois, Inc. | M | ||||||||||

| David E. I. Pyott (LID) | 64 | 1999 | Retired Chairman & CEO, Allergan, Inc. | M | M | |||||||||

| Dean A. Scarborough | 62 | 2000 | Retired Executive Chairman, Avery Dennison Corporation | |||||||||||

| Patrick T. Siewert | 62 | 2005 | Managing Director & Partner, The Carlyle Group | C | | | ||||||||

| Julia A. Stewart | 62 | 2003 | Former Chairman & CEO, DineEquity, Inc. | C | M | |||||||||

| Martha N. Sullivan | 61 | 2013 | President & CEO, Sensata Technologies Holding N.V. | M | M | |

AC = Audit & Finance Committee CC = Compensation & Executive Personnel Committee GC = Governance & Social Responsibility CommitteeM = Member C = Chair LID = Lead Independent Director

Avery Dennison Corporation| 2018 Proxy Statement |viii

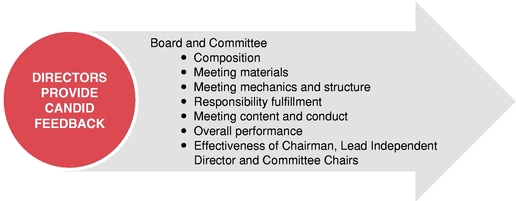

Table of Contents2023 Engagement Feedback

Our director nominees bring a balance of skills, qualificationsWe discussed our leadership transition in all off-season engagements, with investors interested to learn about our Board’s executive succession planning process, engagement with the CEO successor in and demographic backgrounds in overseeingoutside the boardroom, and strategic rationale for determining Mr. Stander to be the right individual to guide our company as highlighted below and shown in greater detail in the Board Matrix included inItem 1 — Electionnext phase of Directors of this proxy statement.

Our governance program reflects our valuesits journey. Stockholders also sought to understand the role, responsibilities and facilitates our Board's independent oversightanticipated tenure of our company. Executive Chairman.

Governance Feedback

Our 2023 engagements provided feedback on the governance matters described below.

| • | Board composition, including the appropriateness of the balance of skills, qualifications, demographic backgrounds and tenure distribution on our Board given our evolving strategies |

| • | Board refreshment and diversity, including our director succession planning process to ensure a robust pipeline of potential new directors, the rationale for recent director appointments and our Governance Committee’s search for new directors with retail/CPG or finance expertise |

| • | Board leadership structure, including our rationale for maintaining a non-independent Chairman complemented by a proactive and engaged Lead Independent Director |

| • | Our stockholder rights profile, particularly the inability of our stockholders to request that we call special meetings of stockholders |

Avery Dennison Corporation | 2024 Proxy Statement | 15 |

Environmental Sustainability Feedback

Environmental sustainability was a significant area of focus for the stockholders with which we engaged. Investors uniformly commended our sustainability transparency in the disclosures contained in our Integrated Reports, proxy statements and ESG Downloads. During our conversations, we primarily discussed the matters described below.

| • | Our progress against our 2025 and 2030 sustainability goals, including our substantial achievement of the former set of goals and whether adjustments would be made to the original goals or would be reflected in our next set of sustainability goals |

| • | Our current focus areas, including goal attainment, actions to address increasing regulatory requirements, improved transparency and ESG ratings agency engagement, and approach to materiality |

| • | Our efforts to reduce Scope 3 GHG emissions, including our investment in internal infrastructure with dedicated procurement resources in each of our business segments; partnership with CDP Supply Chain to optimize engagement with our customers; and measurement methodology, including our potential transition from spend-based to materials-based measurement of these emissions |

| • | Our 2025 goal related to 70% sustainability-driven products, including our criteria for designation as sustainability-driven and our shift from our goals for 2025 focused on our products to our goals for 2030 focused on what our products enable for our customers and end users |

| • | Our efforts toward aligning with TCFD requirements, including our assessment with a third-party expert to understand our physical and transactional risks and our plans to incorporate TCFD into our enterprise risk management (ERM) and long-term strategic planning processes |

| • | Our net zero ambition, including internal strategy development, the impact of our progress reducing Scope 1 and Scope 2 GHG emissions, and our dependence on other parties to reduce Scope 3 GHG emissions |

Executive Compensation and Social Sustainability Feedback

The highlightsprimary focus areas during our 2023 engagements were our leadership transition, Board refreshment and governance profile; executive compensation and social sustainability were not significant topics of discussion. Stockholders did express interest in the impacts of our program are shown below.

✓82% Independent✓Robust Lead Independent Director Role✓Ongoing Director Succession Planning and Board Refreshment✓Executive Succession Planning and Leadership Development✓Annual Board Evaluations✓Mandatory Director Retirement Policy✓Governance Guidelines✓Strong Committee Governance✓Direct Board Access to Management and Experts

ADOPTION OF PROXY ACCESS

In December 2017, responding to feedback from our largest stockholders, our Board amended our bylaws to permit a stockholder, or a group of no more than 20 stockholders, owning at least 3%leadership transition on executive compensation, including the compensation of our company's stock continuously for at least three yearsnew CEO and our Executive Chairman, as well as any additional incentives provided to submit director nominees (upsenior leaders in connection with the transition. Investors continued to 20% ofwant to learn more about the ways in which we incent our Board) for inclusion inleaders to progress toward achieving our proxy materials, subject to the terms and conditions described in our bylaws.sustainability goals.

16 | 2024 Proxy Statement | Avery Dennison Corporation |

APPROVAL OF EXECUTIVE COMPENSATION (ITEM 2)

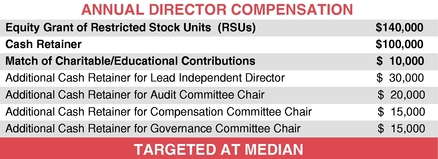

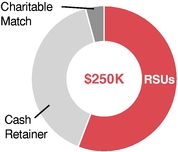

COMPENSATION DESIGN

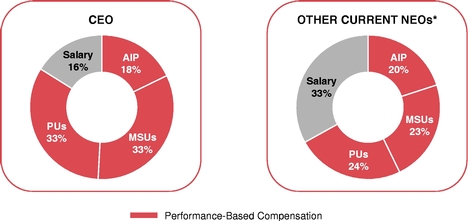

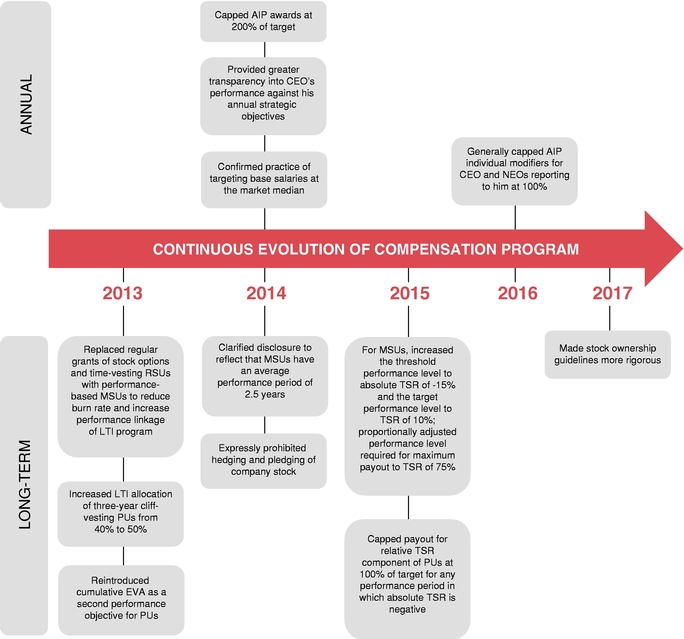

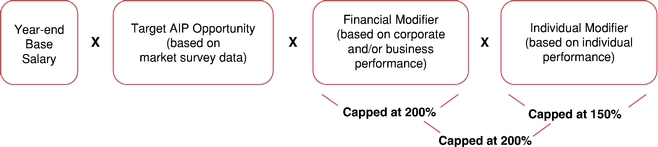

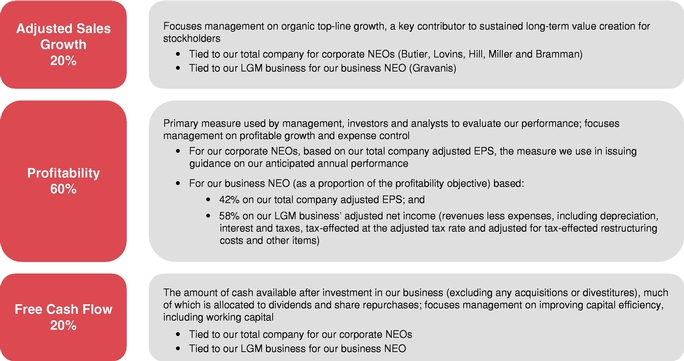

Our Board'sThe Compensation and Executive Personnel Committee (the "Compensation Committee") designsoversees our executive compensation program, which is designed to motivate our executives to execute our business strategies and deliver long-term stockholder value. The program delivers pay for performance, with realized compensation dependent on our company achievingachievement of challenging annual financial targets and long-term financial performance andlonger-term value creation objectives that advance the interests of our stockholders.

Avery Dennison Corporation| 2018 Proxy Statement |ixExecutive Compensation Program

TableThe substantial majority of Contents

PERFORMANCE-BASED COMPENSATION

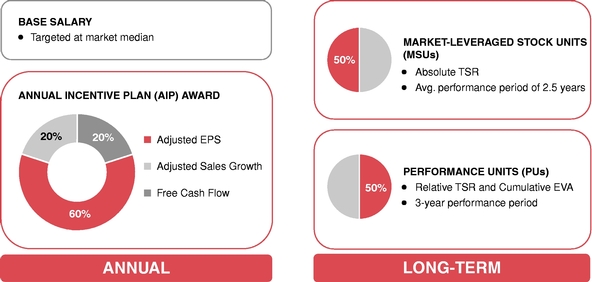

TargetNamed Executive Officer (NEO) target total direct compensation (TDC) tois performance based, meaning that our executives is comprisedultimately may not realize the value of at-risk components if we fail to achieve the following three components:

•Base salary;•Performance-based cash incentive under our Annual Incentive Plan (AIP); and•Long-term incentives delivered in performance-based equity awards, consisting 50% ofdesignated performanceunits (PUs) and 50% of MSUs.

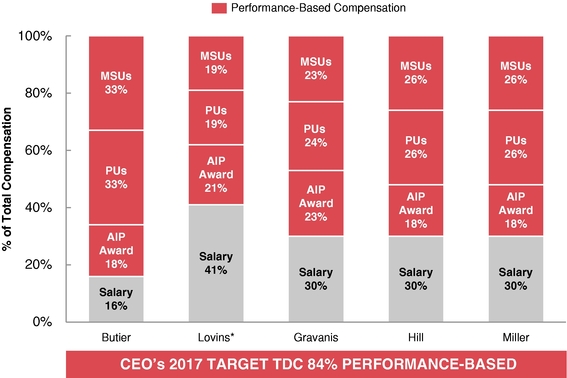

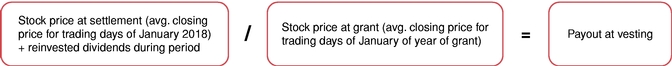

objectives. The Compensation Committee establishesapproves the target TDC of our Named Executive Officers (NEOs)NEOs to incent economicstrong operational and financial performance and stockholder value creation, giving consideration to the market median, role responsibilities, individual performance, tenure, retentioncreation. The mix and succession. The majorityelements of this compensation is performance-based, meaning that our executives may ultimately not realize some or all of these components of compensation if we fail to achieve our financial objectives. In 2017, approximately 84% and 67% of theNEO target TDC of our CEO and average of our other current NEOs, respectively, was performance-based.are shown below.

2017 Target Total Direct Compensation Mix

| ANNUALIZED TARGET TDC MIX | 2023 TARGET TDC MIX | ||||||||

| CEO* |

|  | Avg. of Other NEOs** |

| |||||

| * | Mr. |

| ** | Mr. Butier is excluded because his target 2023 TDC primarily reflected his compensation as CEO given the timing of our leadership transition. Francisco Melo’s target TDC mix included in the average reflects his target TDC as President, Solutions Group. |

| ELEMENTS OF NEO TARGET TDC | ||||||

| LTI Compensation | |||||

| Performance Units (PUs) | Corporate NEOs | Solutions NEO | ||||

• 50% of LTI with payout = 0% to 200% of target award • 3-year performance period - Company EVA(1) (50%) - Company Relative TSR(2) (50%) | • 50% of LTI with payout = 0% to 200% of target award • 3-year performance period - Solutions Group EVA (75%) - Company Relative TSR (25%) | |||||

• Relative TSR payout capped at 100% if absolute TSR is negative | ||||||

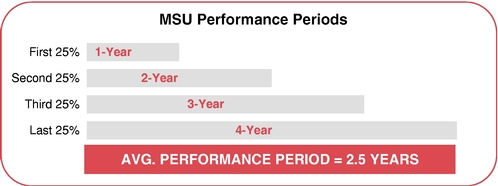

Market-leveraged Stock Units (MSUs) | • 50% of LTI with payout = 0% to 200% of target award • 100% Absolute TSR(3) • 1-, 2-, 3- and 4-year performance periods | |||||

| Annual Incentive Compensation | ||||||

| AIP Award(4) |

|

| ||||

• Drives performance consistent with annual company or business financial goals • Individual performance modifier based on achievement against predetermined strategic and sustainability objectives (generally capped at 100% for NEOs) | ||||||

| Base Salary | • Annual fixed-cash compensation generally set around market median | |||||

| (1) | Economic Value Added (EVA) is a measure of financial performance calculated by deducting the economic cost associated with the use of capital (weighted average cost of capital multiplied by average invested capital) from after-tax operating profit. |

| (2) | Relative TSR compares our TSR to the TSR of companies in a peer group satisfying certain objective criteria described in the Compensation Discussion and Analysis section of this proxy statement. |

| (3) | Absolute TSR measures the return that we provided our stockholders, including stock price appreciation and dividends paid (assuming reinvestment of dividends). |

| (4) | AIP award |

Avery Dennison Corporation | 2024 Proxy Statement | 17 |

PAY-FOR-PERFORMANCE

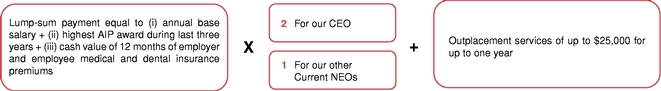

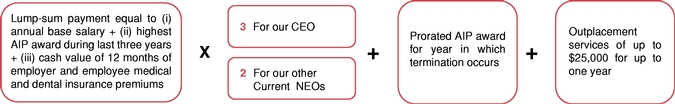

Pay for Performance